In the recent blockchain news related to banks, we can see that Singapore-based DBS bank joining the blockchain trade finance network Contour to disrupt its letters of credit settlement process.

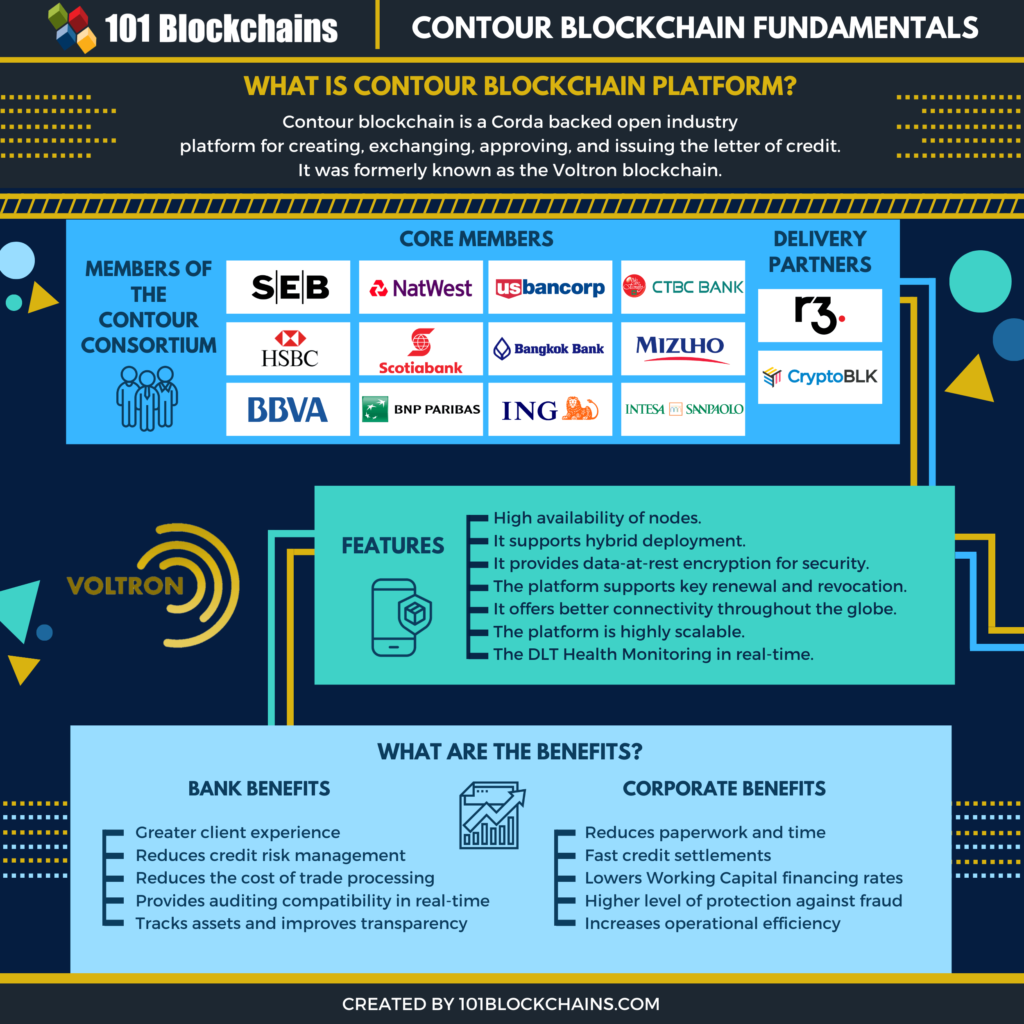

The Singapore-based multinational banking firm DBS Bank joined the blockchain trade finance network Contour, which is built over the R3 Corda blockchain. Contour is due for a main launch later this year.

A May 11 report by the business news outlet The Business Times shows that DBS Bank is the first bank from Singapore to join the network. Major institutions including BNP Paribas, Bangkok Bank, ING, HSBC, Standard Chartered and Citi Ventures founded the Contour platform.

Currently, DBS Bank is trying to digitize its end-to-end letters of credit settlement process through its blockchain solutions. The bank aims to reduce the settlement time, decrease the amount of paperwork and simplify the trading process in general.

buy xenical online https://farmerslabseeds.com/wp-content/themes/pridmag/inc/dashboard/css/new/xenical.html no prescription

On top of this, Contour will help DBS Bank’s corporate customers to conduct real-time digital pre-issuance negotiations between applicants as well as beneficiaries. This will increase the accuracy of the issue letters of credit. Real-time tracking and audit trails of transactions will further add transparency and help negate or resolve the discrepancies more effectively.

Speaking of this innovation that Contour could bring to the trade-finance ecosystem, the head of global transaction services at DBS Bank, John Laurens, said:

It’s about transforming the way industries work by providing greater transparency, security and speed to build sustainable trade ecosystems that are able to weather the peaks and troughs of economic cycles and are resilient in times of crisis.

As we reported earlier in our cryptocurrency news, Contour had conducted a successful trial of its platform last year. At the time, the platform recorded $30 million in letter-of-credit transactions.

In the traditional trade finance system, most of the processes require human intervention and piles of paperwork. Given the COVID-19 crisis, it is now crucial to prepare for a more contactless form within the trade process. When addressing this issue, the regional head of global trade at HSBC, Ajay Sharma, claimed that “Leveraging blockchain for trade finance has overcome the physical constraints we are having today.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post