The Bitcoin news today show that the run-up to the Bitcoin halving has driven near-record volumes. April 30 in specific was the day when the halving hype drove the second largest daily trade on record.

What does all of this mean?

Well, the Bitcoin halving date is approaching and the pre-halving speculation has driven historic volumes of crypto trade, with April 30 producing the second strongest single day for volume on record according to a new report that was published by one market data aggregator.

The notional volume for BTC options on the Chicago Mercantile Exchange (CME) also tagged a new record in the recent days, with 202 contracts changing hands on May 5 which was last week. During this halving hype, around $66.2 billion worth of crypto assets changed hands on April 30, as the Bitcoin BTC price rallied above $9,000 and nearly touched the $10,000 mark for a short while.

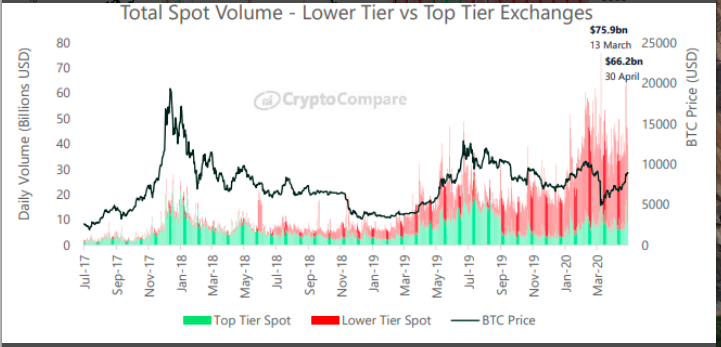

All of this was well received in the cryptonews, and the volume climbed to $75.9 billion in crypto assets which is the second-largest daily volume – after the volumes traded during the historic March 13 flash crash.

According to the data aggregator, the halving hype had 73% of the trades taking place on what they specify as lower tier exchanges, while $17.9 billion traded on top tier platforms (according to them).

Meanwhile, the three largest spot exchanges including Binance, OKEx and Coinbase, represented around 10.4% of the total trade, hosting around $3.6 billion and $2.5 billion in volume, respectively. Coinbase ranked third with $818 million.

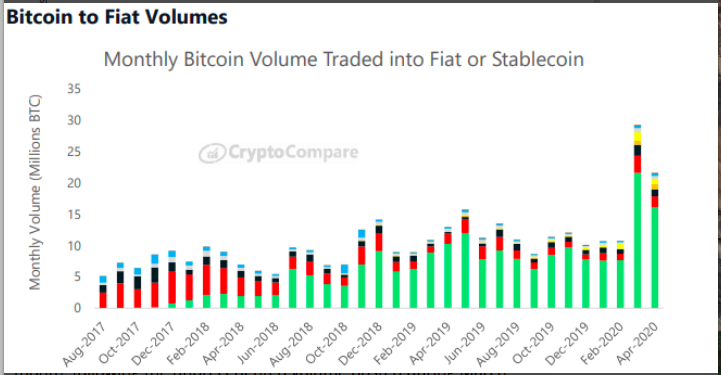

As we can see, the dominance of Tether (USDT) on the markets has continued to extend, while the USDT pairings represented 74% of all trade between Bitcoin and stablecoins or fiat currencies.

The report also found that the halving hype saw Binance as the only exchange which saw growth in derivatives volume last month, following the unprecedented volume posted during March this year.

The Binance news show that the exchange’s monthly derivatives volume grew 11.6% to post $108 billion, overtaking long-time market leader BitMEX, which hosted $69.3 billion in trade amid a 40% volume drop. We can also see that Huobi and OKEx topped the volume rankings during April, with $133 billion and $113 billion in trade despite the monthly trade shrinking by 10.5% (Huobi) and 31.4% (OKEx).

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post