Tether’s supply after the newly minted tokens by the Tether Treasury makes more room for the Bitcoin bulls as BTC crossed the critical $9,000 barrier. The data that we have in our bitcoin price news, suggests that the investors are turning to USDT to prepare for another increase in the price in the broader markets.

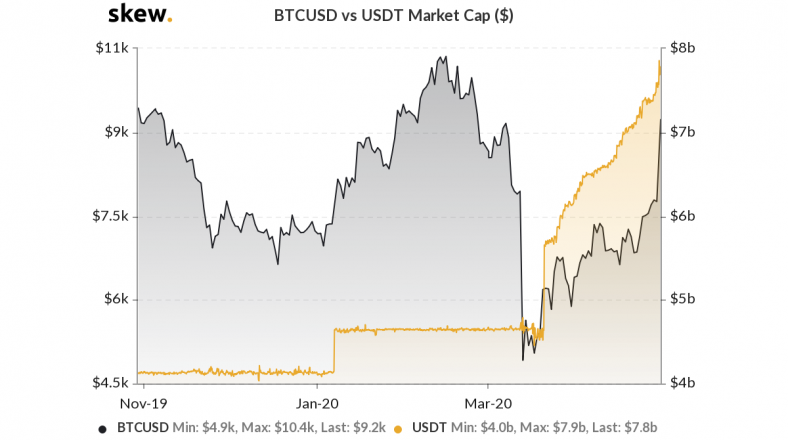

USDT’s market cap boomed by 85% since the cryptocurrency crashed in March. The investors that waited to deploy more capital have fuelled the demand for the stablecoin. Bitcoin still has to cross the $10,500 price point to reverse a trend that started in 2019. Tether’s market cap increased by $3.6 billion in the past two months which is more than the number of tokens issued between 2015 and 2019. The crypto markets gained momentum and the investors will be buying more USDT and will trade it for Bitcoin.

buy super kamagra generic buy super kamagra online no prescription

The rise of stablecoins made investing in crypto much easier and the investors don’t have to waste their time on converting fiat to crypto. They will be able to keep the funds put in stablecoins that are pegged to a fiat currency. Since the market reached a new bottom in March, the total number of Tether’s USDT tokens has doubled from $4.2 billion to $7.8 billion which is a stunning 85% issuance.

Tether’s supply went into an uptrend the previous month and Bitcoin’s price moved along. The General Counsel at Bitfinex Stuart Hoegner commented:

“We are gratified by the recent market demand for USDT, which remains the most trusted, liquid, and popular stablecoin in the ecosystem.”

The halving is 12 days away and the bullish sentiment is kicking in as the fear and green index also doubled over the past week. The crypto asset prices climb higher while the fear of missing BTC’s price appreciation is forming. Hoegner added:

“Possible reasons for the new inflow of fiat and demand for stablecoin issuance might include users wishing to buy other digital assets and using stablecoins as a low-friction on-ramp (as we believe they always have).”

Different investors use different methods but a common way to identify the bullish market trend is to see whether the price will stay above the previous lows while making new highs. The market structure has been bearish since the start of June 2019. In order to reverse this, the price has to sustain above $10,500 which is the last high level for bitcoin set in 2020.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post